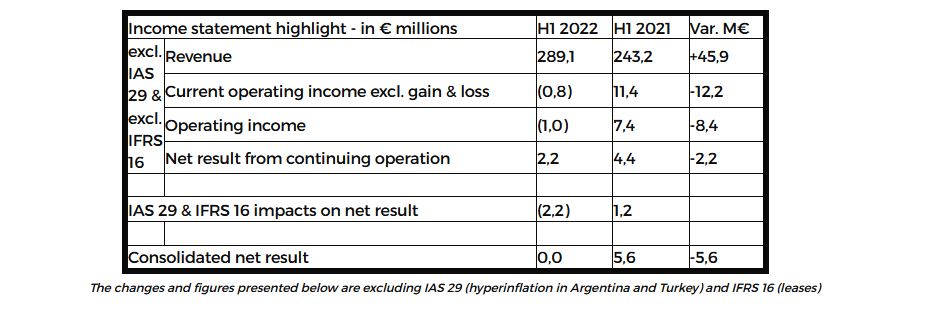

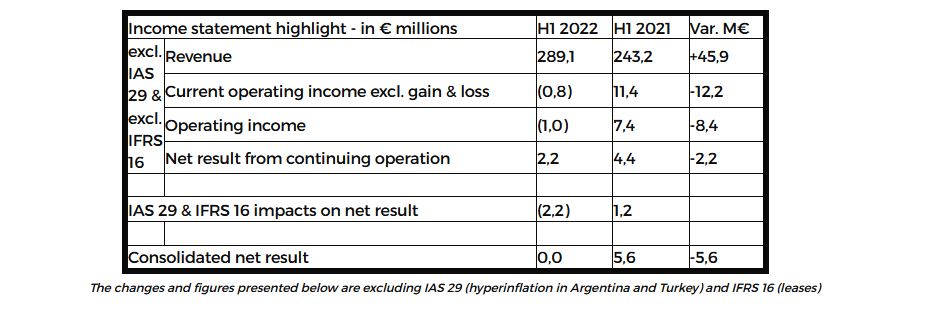

Current operating income (excluding exchange gains and losses) was € (0.8) million, or -0.3% of sales, compared with € 11.4 million, or 4.7% of sales, in the first half of 2021, which was heavily impacted by inflation in the price of components, energy and transport, which accounted for almost € -22 million over the period.

The Group's net income was € 2.2 million, or 0.8% of revenue, positively impacted by foreign exchange gains (€ +6.8 million), mainly due to the strong rise of the US dollar against the Euro.

Working capital requirement continued to increase over the period by € +47.2 million to € 229.8 million, including a € +31.6 million increase in inventory as a result of component shortages and their impact on the production cycle, as well as the increase in production rates due to strong growth in the order book.

The Group's net debt (excluding guarantees and IFRS16) thus amounted to € 189.8 million, up € +48.9 million over the period.

As a reminder, on June 28, 2022, Haulotte obtained a €96 million State Guaranteed Loan from all the lenders of its syndicated loan as well as from BPI France. In addition, a waiver request concerning the non-compliance with its bank ratios for June 2022 was submitted to all the lenders and unanimously accepted without any condition on February 15th, 2022.

Outlook and recent events:

In this context, buoyed by a historical order book that is still increasing, Haulotte confirms its sales growth forecasts of more than +20% in 2022, despite persistent supply difficulties for certain components. As announced during the Q1 2022 revenue release, the Group is not in a position to confirm, at this stage, its current operating margin objectives for 2022 due to the lack of visibility and the many uncertainties that remain.

Upcoming event

Quarter 3 Sales: October 18th, 2022